题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The Hi Life Co (HL Co) makes sofas. It has recently received a request from a customer to

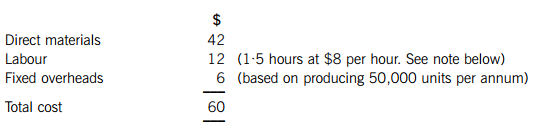

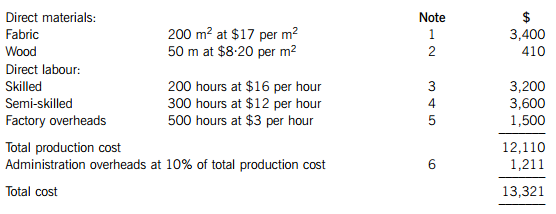

The Hi Life Co (HL Co) makes sofas. It has recently received a request from a customer to provide a one-off order of sofas, in excess of normal budgeted production. The order would need to be completed within two weeks. The following cost estimate has already been prepared:

Notes

1 The fabric is regularly used by HL Co. There are currently 300 m2 in inventory, which cost $17 per m2. The current purchase price of the fabric is $17·50 per m2.

2 This type of wood is regularly used by HL Co and usually costs $8·20 per m2. However, the company’s current supplier’s earliest delivery time for the wood is in three weeks’ time. An alternative supplier could deliver immediately but they would charge $8·50 per m2. HL Co already has 500 m2 in inventory but 480 m2 of this is needed to complete other existing orders in the next two weeks. The remaining 20 m2 is not going to be needed until four weeks’ time.

3 The skilled labour force is employed under permanent contracts of employment under which they must be paid for 40 hours’ per week’s labour, even if their time is idle due to absence of orders. Their rate of pay is $16 per hour, although any overtime is paid at time and a half. In the next two weeks, there is spare capacity of 150 labour hours.

4 There is no spare capacity for semi-skilled workers. They are currently paid $12 per hour or time and a half for overtime. However, a local agency can provide additional semi-skilled workers for $14 per hour.

5 The $3 absorption rate is HL Co’s standard factory overhead absorption rate; $1·50 per hour reflects the cost of the factory supervisor’s salary and the other $1·50 per hour reflects general factory costs. The supervisor is paid an annual salary and is also paid $15 per hour for any overtime he works. He will need to work 20 hours’ overtime if this order is accepted.

6 This is an apportionment of the general administration overheads incurred by HL Co. Required: Prepare, on a relevant cost basis, the lowest cost estimate which could be used as the basis for the quotation. Explain briefly your reasons for including or excluding each of the costs in your estimate.

Required:

Prepare, on a relevant cost basis, the lowest cost estimate which could be used as the basis for the quotation. Explain briefly your reasons for including or excluding each of the costs in your estimate.

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The Hi Life Co (HL Co) makes s…”相关的问题

更多“The Hi Life Co (HL Co) makes s…”相关的问题