题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Based on Unit 3 Text B: Before he got the four words from his English teacher, Dalkof

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Based on Unit 3 Text B: Before…”相关的问题

更多“Based on Unit 3 Text B: Before…”相关的问题

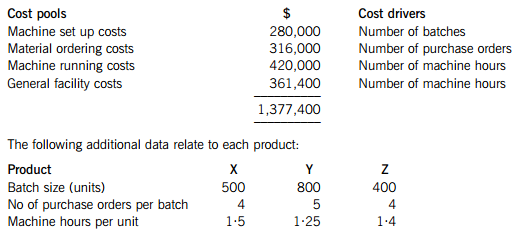

Budgeted production and sales volumes for X, Y and Z for the next year are 20,000 units, 16,000 units and 22,000 units respectively.

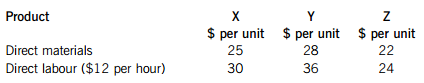

The budgeted direct costs of the three products are shown below:

In the next year, Duff Co also expects to incur indirect production costs of $1,377,400, which are analysed as follows:

Duff Co wants to boost sales revenue in order to increase profits but its capacity to do this is limited because of its use of cost plus pricing and the application of the standard mark-up. The finance director has suggested using activity based costing (ABC) instead of full absorption costing, since this will alter the cost of the products and may therefore enable a different price to be charged.

Required:

(a) Calculate the budgeted full production cost per unit of each product using Duff Co’s current method of absorption costing. All workings should be to two decimal places. (3 marks)

(b) Calculate the budgeted full production cost per unit of each product using activity based costing. All workings should be to two decimal places. (11 marks)

(c) Discuss the impact on the selling prices and the sales volumes OF EACH PRODUCT which a change to activity based costing would be expected to bring about. (6 marks)

Heat Co is now trying to ascertain the best pricing policy that they should adopt for the Energy Buster’s launch onto the market. Demand is very responsive to price changes and research has established that, for every $15 increase in price, demand would be expected to fall by 1,000 units. If the company set the price at $735, only 1,000 units would be demanded.

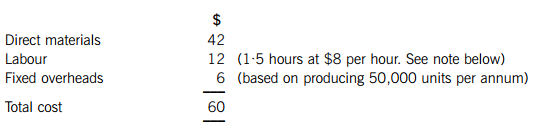

The costs of producing each air conditioning unit are as follows:

Note

The first air conditioning unit took 1·5 hours to make and labour cost $8 per hour. A 95% learning curve exists, in relation to production of the unit, although the learning curve is expected to finish after making 100 units. Heat Co’s management have said that any pricing decisions about the Energy Buster should be based on the time it takes to make the 100th unit of the product. You have been told that the learning co-efficient, b = –0·0740005.

All other costs are expected to remain the same up to the maximum demand levels.

Required:

(a) (i) Establish the demand function (equation) for air conditioning units; (3 marks)

(ii) Calculate the marginal cost for each air conditioning unit after adjusting the labour cost as required by the note above; (6 marks)

(iii) Equate marginal cost and marginal revenue in order to calculate the optimum price and quantity. (3 marks)

(b) Explain what is meant by a ‘penetration pricing’ strategy and a ‘market skimming’ strategy and discuss whether either strategy might be suitable for Heat Co when launching the Energy Buster. (8 marks)