题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

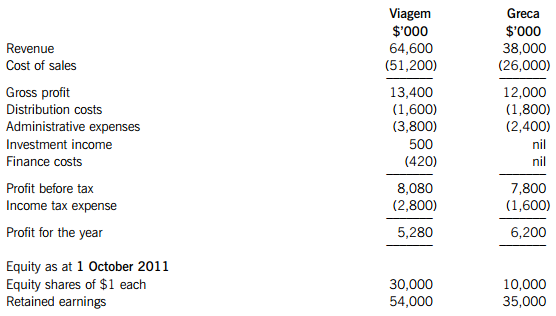

On 1 January 2012, Viagem acquired 90% of the equity share capital of Greca in a share exc

At the date of acquisition, shares in Viagem and Greca had a stock market value of $6·50 and $2·50 each, respectively.

Income statements for the year ended 30 September 2012

The following information is relevant:

(i) At the date of acquisition, the fair values of Greca’s assets were equal to their carrying amounts with the exception of two items:

– An item of plant had a fair value of $1·8 million above its carrying amount. The remaining life of the plant at the date of acquisition was three years. Depreciation is charged to cost of sales.

– Greca had a contingent liability which Viagem estimated to have a fair value of $450,000. This has not changed as at 30 September 2012.

Greca has not incorporated these fair value changes into its financial statements.

(ii) Viagem’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Greca’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

(iii) Sales from Viagem to Greca throughout the year ended 30 September 2012 had consistently been $800,000 per month. Viagem made a mark-up on cost of 25% on these sales. Greca had $1·5 million of these goods in inventory as at 30 September 2012.

(iv) Viagem’s investment income is a dividend received from its investment in a 40% owned associate which it has held for several years. The underlying earnings for the associate for the year ended 30 September 2012 were $2 million.

(v) Although Greca has been profitable since its acquisition by Viagem, the market for Greca’s products has been badly hit in recent months and Viagem has calculated that the goodwill has been impaired by $2 million as at 30 September 2012.

Required:

(a) Calculate the consolidated goodwill at the date of acquisition of Greca.

(b) Prepare the consolidated income statement for Viagem for the year ended 30 September 2012. The following mark allocation is provided as guidance for these requirements:

(a) 7 marks

(b) 14 marks

(c) The carrying amount of a subsidiary’s leased property will be subject to review as part of the fair value exercise on acquisition and may be subject to review in subsequent periods.

Required:

Explain how a fair value increase of a subsidiary’s leased property on acquisition should be treated in the consolidated financial statements; and how any subsequent increase in the carrying amount of the leased property might be treated in the consolidated financial statements.

Note: Ignore taxation. (4 marks)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“On 1 January 2012, Viagem acqu…”相关的问题

更多“On 1 January 2012, Viagem acqu…”相关的问题