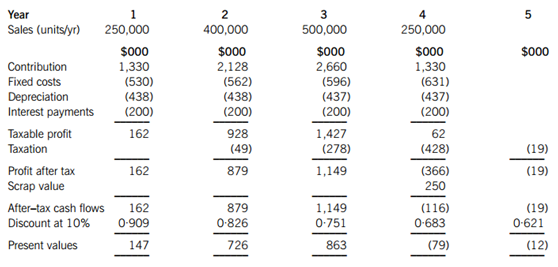

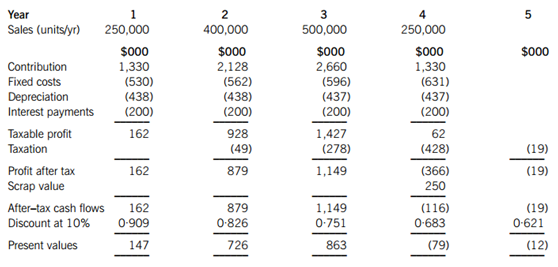

The following draft appraisal of a proposed investment project has been prepared for the f

i nance director of OKM Co by a trainee accountant. The project is consistent with the current business operations of OKM Co.

Net present value = 1,645,000 – 2,000,000 = ($355,000) so reject the project.

The following information was included with the draft investment appraisal:

1. The initial investment is $2 million

2. Selling price: $12/unit (current price terms), selling price infl ation is 5% per year

3. Variable cost: $7/unit (current price terms), variable cost infl ation is 4% per year

4. Fixed overhead costs: $500,000/year (current price terms), fi xed cost infl ation is 6% per year

5. $200,000/year of the fi xed costs are development costs that have already been incurred and are being recovered by an annual charge to the project

6. Investment fi nancing is by a $2 million loan at a fi xed interest rate of 10% per year

7. OKM Co can claim 25% reducing balance capital allowances on this investment and pays taxation one year in arrears at a rate of 30% per year

8. The scrap value of machinery at the end of the four-year project is $250,000

9. The real weighted average cost of capital of OKM Co is 7% per year

10. The general rate of infl ation is expected to be 4?7% per year

Required:

(a) Identify and comment on any errors in the investment appraisal prepared by the trainee accountant. (5 marks)

(b) Prepare a revised calculation of the net present value of the proposed investment project and comment on the project’s acceptability. (12 marks)

(c) Discuss the problems faced when undertaking investment appraisal in the following areas and comment on how these problems can be overcome:

(i) assets with replacement cycles of different lengths;

(ii) an investment project has several internal rates of return;

(iii) the business risk of an investment project is signifi cantly different from the business risk of current operations. (8 marks)

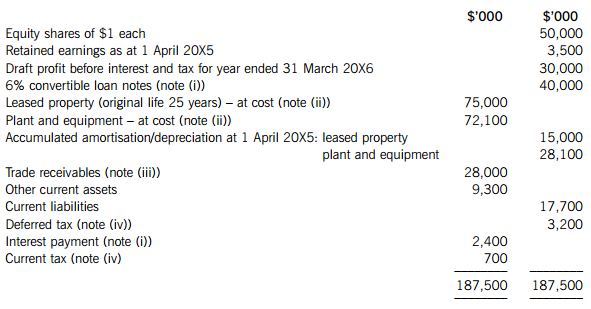

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“An FI's net interest income re…”相关的问题

更多“An FI's net interest income re…”相关的问题