题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

Under accrual basis, no adjustment is needed for the transaction with timing differenc

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“Under accrual basis, no adjust…”相关的问题

更多“Under accrual basis, no adjust…”相关的问题

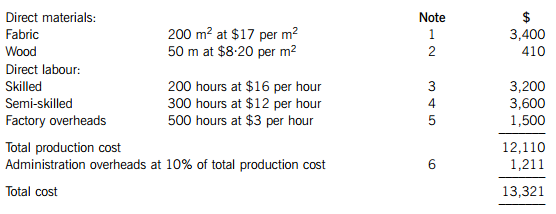

The Hi Life Co (HL Co) makes sofas. It has recently received a request from a customer to provide a one-off order of sofas, in excess of normal budgeted production. The order would need to be completed within two weeks. The following cost estimate has already been prepared:

Notes

1 The fabric is regularly used by HL Co. There are currently 300 m2 in inventory, which cost $17 per m2. The current purchase price of the fabric is $17·50 per m2.

2 This type of wood is regularly used by HL Co and usually costs $8·20 per m2. However, the company’s current supplier’s earliest delivery time for the wood is in three weeks’ time. An alternative supplier could deliver immediately but they would charge $8·50 per m2. HL Co already has 500 m2 in inventory but 480 m2 of this is needed to complete other existing orders in the next two weeks. The remaining 20 m2 is not going to be needed until four weeks’ time.

3 The skilled labour force is employed under permanent contracts of employment under which they must be paid for 40 hours’ per week’s labour, even if their time is idle due to absence of orders. Their rate of pay is $16 per hour, although any overtime is paid at time and a half. In the next two weeks, there is spare capacity of 150 labour hours.

4 There is no spare capacity for semi-skilled workers. They are currently paid $12 per hour or time and a half for overtime. However, a local agency can provide additional semi-skilled workers for $14 per hour.

5 The $3 absorption rate is HL Co’s standard factory overhead absorption rate; $1·50 per hour reflects the cost of the factory supervisor’s salary and the other $1·50 per hour reflects general factory costs. The supervisor is paid an annual salary and is also paid $15 per hour for any overtime he works. He will need to work 20 hours’ overtime if this order is accepted.

6 This is an apportionment of the general administration overheads incurred by HL Co. Required: Prepare, on a relevant cost basis, the lowest cost estimate which could be used as the basis for the quotation. Explain briefly your reasons for including or excluding each of the costs in your estimate.

Required:

Prepare, on a relevant cost basis, the lowest cost estimate which could be used as the basis for the quotation. Explain briefly your reasons for including or excluding each of the costs in your estimate.

A.How should this $2 million future cost be recognised in the financial statements().

B.Provision $2 million and $2 million capitalised as part of cost of mine

C.Provision $2 million and $2 million charged to operating costs

D.Accrual $200,000 per annum for next ten years

E.Should not be recognised as no cost has yet arisen

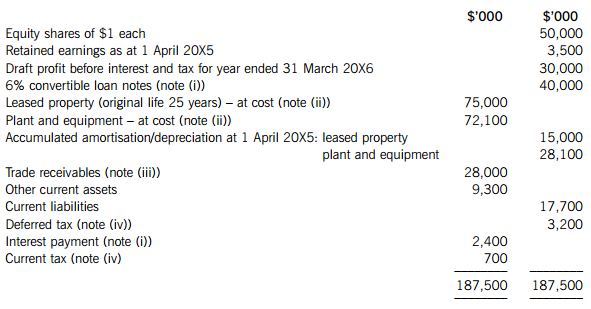

After preparing a draft statement of profit or loss (before interest and tax) for the year ended 31 March 20X6 (before any adjustments which may be required by notes (i) to (iv) below), the summarised trial balance of Triage Co as at 31 March 20X6 is:

The following notes are relevant:

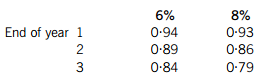

(i) Triage Co issued 400,000 $100 6% convertible loan notes on 1 April 20X5. Interest is payable annually in arrears on 31 March each year. The loans can be converted to equity shares on the basis of 20 shares for each $100 loan note on 31 March 20X8 or redeemed at par for cash on the same date. An equivalent loan without the conversion rights would have required an interest rate of 8%.

The present value of $1 receivable at the end of each year, based on discount rates of 6% and 8%, are:

(ii) Non-current assets:

The directors decided to revalue the leased property at $66·3m on 1 October 20X5. Triage Co does not make an annual transfer from the revaluation surplus to retained earnings to reflect the realisation of the revaluation gain; however, the revaluation will give rise to a deferred tax liability at the company’s tax rate of 20%.

The leased property is depreciated on a straight-line basis and plant and equipment at 15% per annum using the reducing balance method.

No depreciation has yet been charged on any non-current assets for the year ended 31 March 20X6.

(iii) In September 20X5, the directors of Triage Co discovered a fraud. In total, $700,000 which had been included as receivables in the above trial balance had been stolen by an employee. $450,000 of this related to the year ended 31 March 20X5, the rest to the current year. The directors are hopeful that 50% of the losses can be recovered from the company’s insurers.

(iv) A provision of $2·7m is required for current income tax on the profit of the year to 31 March 20X6. The balance on current tax in the trial balance is the under/over provision of tax for the previous year. In addition to the temporary differences relating to the information in note (ii), at 31 March 20X6, the carrying amounts of Triage Co’s net assets are $12m more than their tax base.

Required:

(a) Prepare a schedule of adjustments required to the draft profit before interest and tax (in the above trial balance) to give the profit or loss of Triage Co for the year ended 31 March 20X6 as a result of the information in notes (i) to (iv) above.

(b) Prepare the statement of financial position of Triage Co as at 31 March 20X6.

(c) The issue of convertible loan notes can potentially dilute the basic earnings per share (EPS). Calculate the diluted earnings per share for Triage Co for the year ended 31 March 20X6 (there is no need to calculate the basic EPS).

Note: A statement of changes in equity and the notes to the statement of financial position are not required.

The following mark allocation is provided as guidance for this question:

(a) 5 marks

(b) 12 marks

(c) 3 marks

A.Permutations

B.Work factor

C.Factorability

D.Reversivibility

A.prevail

B.prevailing

C.prevalence

D.prevalent

Equipment should be tested and maintained for proper operation on a regular().

A、base

B、ground

C、basis

D、field

A.twice in each month

B.in two-week divisions

C.every two weeks

D.on a two-weekly basis