题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The three sales representatives of this company will be () with a trip to France .

A.offered

B.awarded

C.rewarded

D.given

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A.offered

B.awarded

C.rewarded

D.given

如果结果不匹配,请 联系老师 获取答案

如果结果不匹配,请 联系老师 获取答案

更多“The three sales representative…”相关的问题

更多“The three sales representative…”相关的问题

A.turn up

B.get up

C.come up with

D.put up with

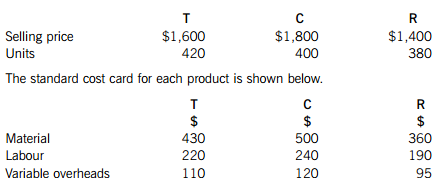

Cardio Co manufactures three types of fitness equipment: treadmills (T), cross trainers (C) and rowing machines (R). The budgeted sales prices and volumes for the next year are as follows:

Labour costs are 60% fixed and 40% variable. General fixed overheads excluding any fixed labour costs are expected to be $55,000 for the next year.

Required:

(a) Calculate the weighted average contribution to sales ratio for Cardio Co. (4 marks)

(b) Calculate the margin of safety in $ revenue for Cardio Co. (3 marks)

(c) Using the graph paper provided and assuming that the products are sold in a CONSTANT MIX, draw a multi-product breakeven chart for Cardio Co. Label fully both axes, any lines drawn on the graph and the breakeven point. (6 marks)

(d) Explain what would happen to the breakeven point if the products were sold in order of the most profitable products first.

Note: You are NOT required to demonstrate this on the graph drawn in part (c). (2 marks)

Xiaoyan tells David about the people she works with.

David: So who do you usually work with in Shanghai?

Xiaoyan: I work in an office with three other people, Jung, Lee and Liu – they are the Marketing Department and I am their IT expert.

David: do you like it there?

Xiaoyan: Yes, they’re great people.Lee is the Sales Manager.He is responsible for 25 sales people in China.He’s planning a sales campaign for companies at the moment, but he’s visiting the New York office right now.

David: What about the others?

Xiaoyan: Liu is the advertising manager.He’s responsible for the advertising.He’s currently working on TV advertisements.Actually, he’s on holiday in Bali right now.

David: So the office is empty at the moment.

Xiaoyan: Oh no.Jung is always there.She’s the secretary.She’s responsible for the office.

At the moment she’s working on new databases.But actually – it’s 1.00 o’clock in the morning in Shanghai, so I think she’s sleeping right now.

1、How many people does Xiaoyan work with in Shanghai? ().

A.Two

B.Three

C.Four

2、What does Xiaoyan do in the Marketing Department in Shanghai? ().

A.She is a secretary

B.She is an IT expert

C.She is the Sales Manager

3、What is Lee responsible for? ().

A.The advertising

B.The sales people

C.The office

4、What is Liu doing right now? ()

A.He is on holiday.

B.He is working on TV advertisements

C.He is visiting the New York office.

5、What is Jung’s current project? ()

A.A sales campaign.

B.TV advertisements.

C.New databases.

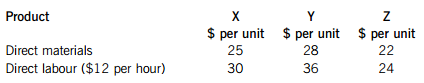

Budgeted production and sales volumes for X, Y and Z for the next year are 20,000 units, 16,000 units and 22,000 units respectively.

The budgeted direct costs of the three products are shown below:

In the next year, Duff Co also expects to incur indirect production costs of $1,377,400, which are analysed as follows:

Duff Co wants to boost sales revenue in order to increase profits but its capacity to do this is limited because of its use of cost plus pricing and the application of the standard mark-up. The finance director has suggested using activity based costing (ABC) instead of full absorption costing, since this will alter the cost of the products and may therefore enable a different price to be charged.

Required:

(a) Calculate the budgeted full production cost per unit of each product using Duff Co’s current method of absorption costing. All workings should be to two decimal places. (3 marks)

(b) Calculate the budgeted full production cost per unit of each product using activity based costing. All workings should be to two decimal places. (11 marks)

(c) Discuss the impact on the selling prices and the sales volumes OF EACH PRODUCT which a change to activity based costing would be expected to bring about. (6 marks)

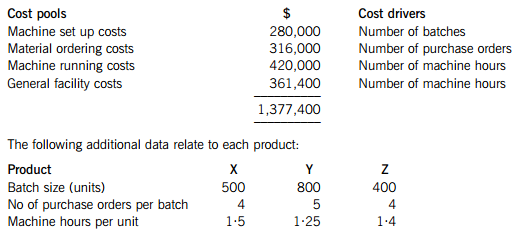

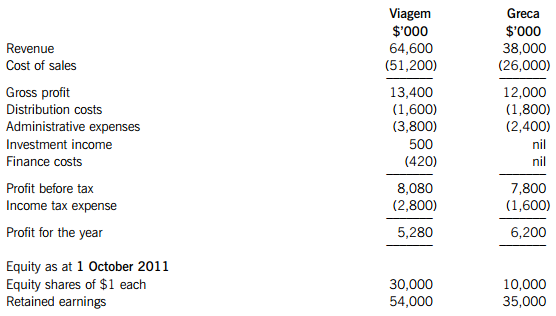

At the date of acquisition, shares in Viagem and Greca had a stock market value of $6·50 and $2·50 each, respectively.

Income statements for the year ended 30 September 2012

The following information is relevant:

(i) At the date of acquisition, the fair values of Greca’s assets were equal to their carrying amounts with the exception of two items:

– An item of plant had a fair value of $1·8 million above its carrying amount. The remaining life of the plant at the date of acquisition was three years. Depreciation is charged to cost of sales.

– Greca had a contingent liability which Viagem estimated to have a fair value of $450,000. This has not changed as at 30 September 2012.

Greca has not incorporated these fair value changes into its financial statements.

(ii) Viagem’s policy is to value the non-controlling interest at fair value at the date of acquisition. For this purpose, Greca’s share price at that date can be deemed to be representative of the fair value of the shares held by the non-controlling interest.

(iii) Sales from Viagem to Greca throughout the year ended 30 September 2012 had consistently been $800,000 per month. Viagem made a mark-up on cost of 25% on these sales. Greca had $1·5 million of these goods in inventory as at 30 September 2012.

(iv) Viagem’s investment income is a dividend received from its investment in a 40% owned associate which it has held for several years. The underlying earnings for the associate for the year ended 30 September 2012 were $2 million.

(v) Although Greca has been profitable since its acquisition by Viagem, the market for Greca’s products has been badly hit in recent months and Viagem has calculated that the goodwill has been impaired by $2 million as at 30 September 2012.

Required:

(a) Calculate the consolidated goodwill at the date of acquisition of Greca.

(b) Prepare the consolidated income statement for Viagem for the year ended 30 September 2012. The following mark allocation is provided as guidance for these requirements:

(a) 7 marks

(b) 14 marks

(c) The carrying amount of a subsidiary’s leased property will be subject to review as part of the fair value exercise on acquisition and may be subject to review in subsequent periods.

Required:

Explain how a fair value increase of a subsidiary’s leased property on acquisition should be treated in the consolidated financial statements; and how any subsequent increase in the carrying amount of the leased property might be treated in the consolidated financial statements.

Note: Ignore taxation. (4 marks)

But after decades of hype, American offices may finally be losing their paper obsession. The demand for paper used to outstrip the growth of the US economy, but the past two or three years have seen a marked slowdown in sales—despite a healthy economic scene.

Analysts attribute the decline to such factors as advances in digital databases and communication systems. Escaping our craving for paper, however, will be anything but an easy affair.

"Old habits are hard to break," says Merilyn Dunn, a communications supplies director. "There are some functions that paper serves where a screen display doesn't work. Those functions are both its strength and its weakness. "

In the early to mid-90s, a booming economy and improved desktop printers helped boost paper sales by 6 to 7 percent each year. The convenience of desktop printing allowed office workers to indulge in printing anything and everything at very little effort or cost.

But now, the growth rate of paper sales in the United States is flattening by about half a percent each year. Between 2004 and 2005, Ms. Dunn says, plain white office paper will see less than a 4 percent growth rate, despite the strong overall economy. A primary reason for the change, says Dunn, is that for the first time ever, some 47 percent of the workforce entered the job market after computers had already been introduced to offices.

"We're finally seeing a reduction in the amount of paper being used per worker in the workplace," says John Maine, vice president of a pulp and paper economic consulting firm. "More information is being transmitted electronically, and more and more people are comfortable with the information residing only in electronic form. without printing multiple backups. "

In addition, Mr. Maine points to the lackluster employment market for white-collar workers—the primary driver of office paper consumption—for the shift in paper usage.

The real paradigm shift may be in the way paper is used. Since the advent of advanced and reliable office-network systems, data storage has moved away from paper archives. The secretarial art of "filing" is disappearing from job descriptions. Much of today's data may never leave its original digital format.

The changing attitudes toward paper have finally caught the attention of paper companies, says Richard Harper, a researcher at Microsoft. "All of a sudden, the paper industry has started thinking. 'We need to learn more about the behavioural aspects of paper use. '" he says. "They had never asked, they'd just assumed that 70 million sheets would be bought per year as a literal function of economic growth. "

To reduce paper use, some companies are working to combine digital and paper capabilities.

For example, Xerox Corp. is developing electronic paper: thin digital displays that respond to a stylus, like a pen on paper. Notations can be erased or saved digitally.

Another idea, intelligent paper, comes from Anoto Group. It would allow notations made with a stylus on a page printed with a special magnetic ink to simultaneously appear on a computer screen.

Even with such technological advances, the improved capabilities of digital storage continue to act against "paperlessness," argues Paul Saffo, a technology forecaster. In his prophetic and metaphorical 1989 essay, "The Electronic Pinata (彩罐)", he suggests that the increasing amounts of electronic data necessarily require more paper.

The information industry today is like a huge electronic pinata, composed of a thin paper crust surrounding an electronic core. " Mr. Saffo wrote. The growing paper crust "is most noticeab

A.It further explains high-tech hubris.

B.It confirms the effect of high-tech hubris.

C.It offers a cause for high-tech hubris.

D.It offers a contrast to high-tech hubris.

Saxophone Enterprises Co (Saxophone) has been trading for 15 years selling insurance and has recently become a listed company. In accordance with corporate governance principles Saxophone maintains a small internal audit department. The directors feel that the team needs to increase in size and specialist skills are required, but they are unsure whether to recruit more internal auditors, or to outsource the whole function to their external auditors, Cello & Co.

Saxophone is required to comply with corporate governance principles in order to maintain its listed status; hence the finance director has undertaken a review of whether or not the company complies.

Bill Bassoon is the chairman of Saxophone, until last year he was the chief executive. Bill is unsure if Saxophone needs more non-executive directors as there are currently three non-executive directors out of the eight board members. He is considering appointing one of his close friends, who is a retired chief executive of a manufacturing company, as a non-executive director.

The finance director, Jessie Oboe, decides on the amount of remuneration each director is paid. Currently all remuneration is in the form. of an annual bonus based on profits. Jessie is considering setting up an audit committee, but has not undertaken this task yet as she is very busy. A new sales director was appointed nine months ago. He has yet to undertake his board training as this is normally provided by the chief executive and this role is currently vacant.

There are a large number of shareholders and therefore the directors believe that it is impractical and too costly to hold an annual general meeting of shareholders. Instead, the board has suggested sending out the financial statements and any voting resolutions by email; shareholders can then vote on the resolutions via email.

Required:

(a) Explain the advantages and disadvantages for each of Saxophone Enterprises Co AND Cello & Co of outsourcing the internal audit department.

Note: The total marks will be split as follows:

Saxophone Enterprises Co (8 marks)

Cello & Co (2 marks) (10 marks)

(b) In respect of the corporate governance of Saxophone Enterprises Co:

(i) Identify and explain FIVE corporate governance weaknesses; and

(ii) Provide a recommendation to address each weakness.

Note: The total marks will be split equally between each part. (10 marks)

The marketing department()the sales for the last six months.

A. has summarized

B. summarized

C. was summarized

A.sale

B.sales

C.sailing

D.sealing

A.Subtracting cost of sales from sales.

B.Subtracting sales returns and sales discounts from sales.

C.Subtracting sales returns, cost of sales, and sales discounts from sales.

D.Subtracting gross profit from sales.